Market Leadership:

Consistent Growth:

Opening 16/07/24

SOLIS offers reliable

dividends thanks to

predictable earnings from

long-term contracts,

appealing to investors

seeking steady income.

With a strong reputation,

client relationships, and

brand representation,

SOLIS is set for ongoing,

growth, enhancing

investment value.

Long-term contracts

enable consistent and

predictable revenue. This

drives the SOLIS business,

model

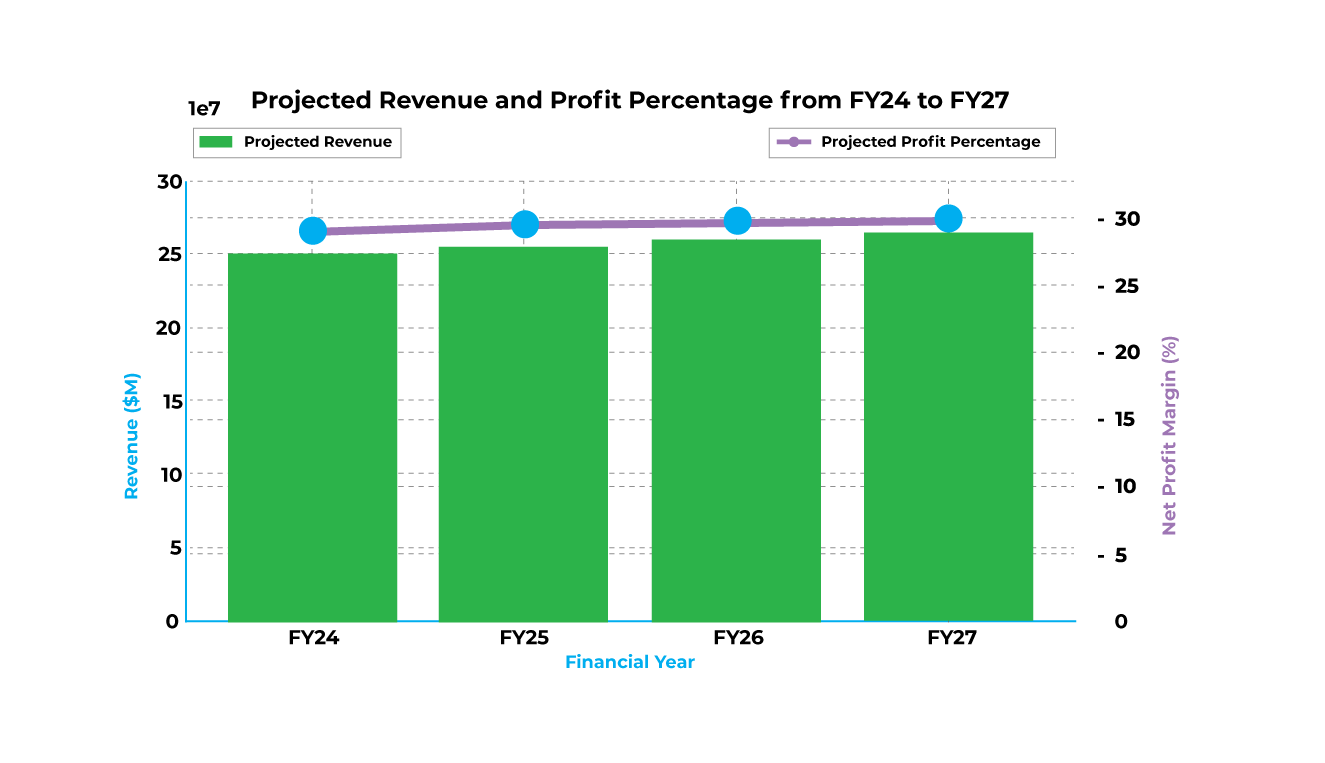

SOLIS expects an expansion

in technology-related

revenue streams as the

core product range of

photocopiers and printers.

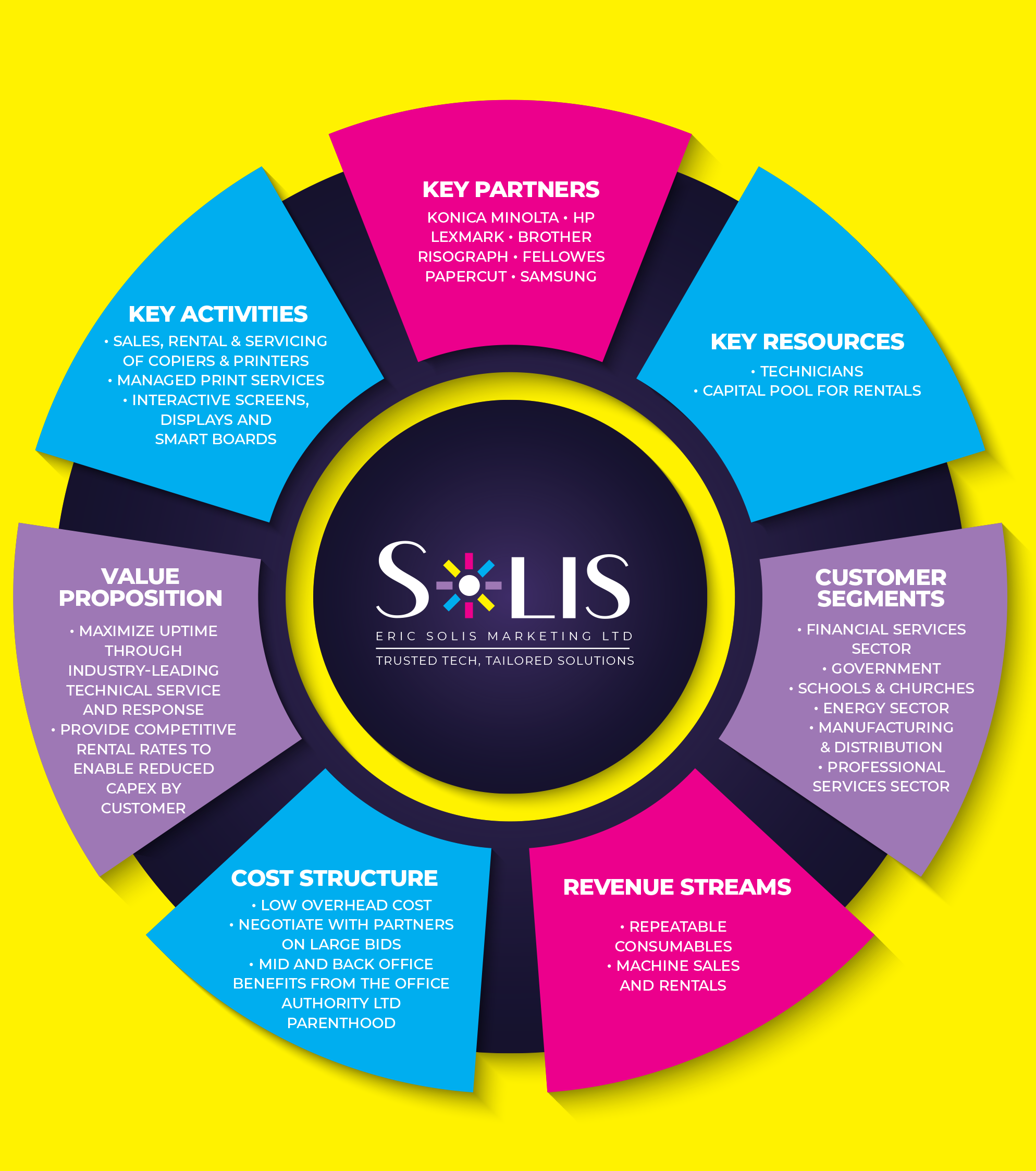

50+ year old family business, bought by The Office Authority Ltd in 2007. Track record of quality service, high level of repeat business and consistent profitability.

The Office Authority Ltd is a privately held amalgamated company formed to house several acquisitions - Trinpad, Office Express, Media Sales, Media Print, CPPP, Fine Papers Division of Trinidad Tissues Ltd.

We possess subject matter expertise and a strong technical services background, with mid and back level shared services & executive office functions supported by the office authority ltd.

The Board is comprised of two independent parties and three executive directors.

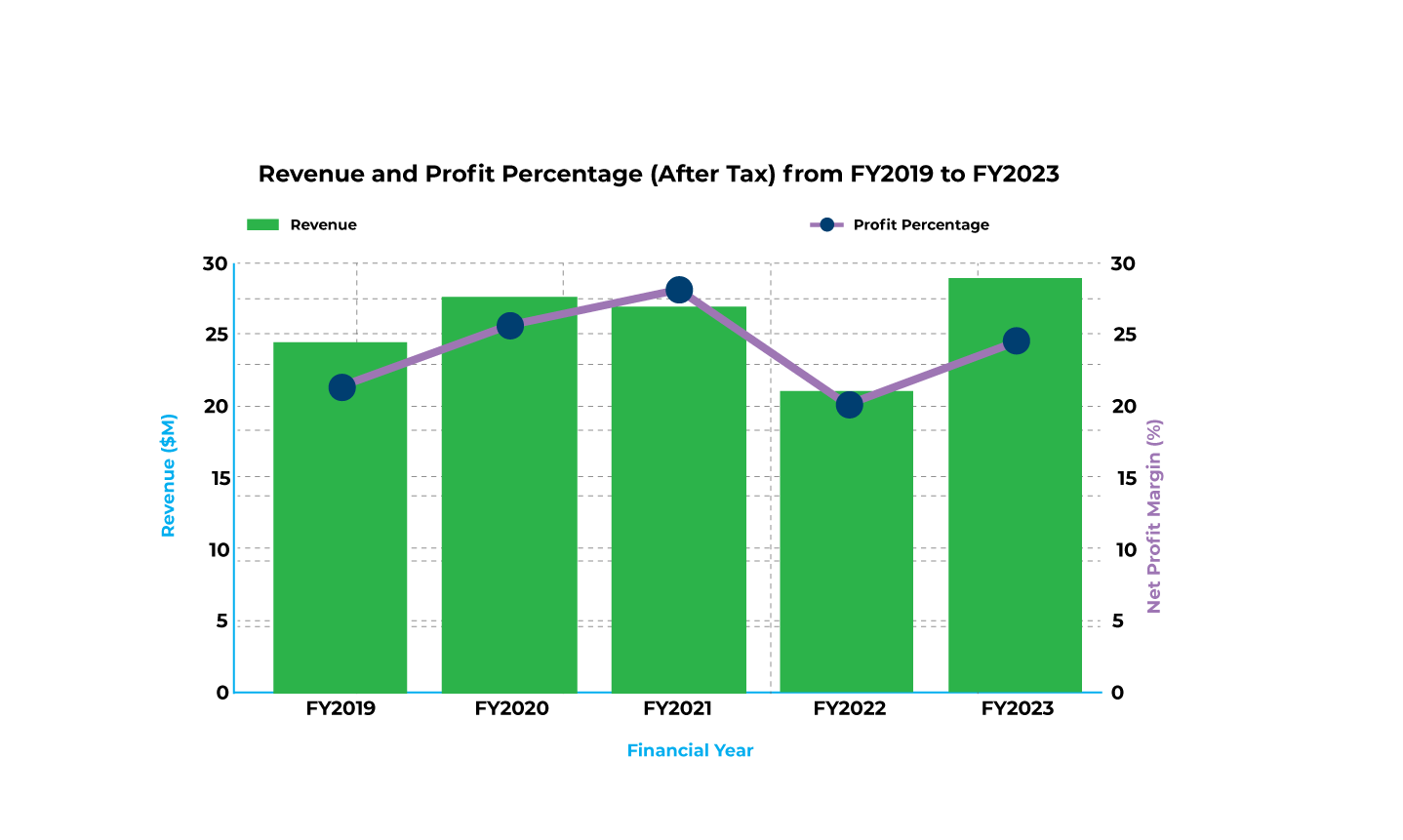

Consistent growth (20% over 5 years), net profit margin consistently > 10%, expected dividend quality service, high level of repeat business and yield > 10% at IPO price.

SOLIS is excited to

announce our upcoming

stock market listing.

Our goal? To expand our

photocopier and printer

rental fleet and branch into

additional technology-

related revenue streams.

Thousands of our devices

are already in use across

Trinidad & Tobago. With

public investment, we plan

to significantly increase

this footprint.

Our business model

aims to provide

consistent and stable

dividend streams

to investors.

For the first 5 years, SOLIS benefits from 0% corporation tax, Green Fund, and Business levy, followed by a 50%

reduction in these taxes for years 6-10.

The capital being raised in the IPO is expected to enable:

SOLIS Initial Public Offering (IPO) invites the general public

to subscribe to a pool of up to 2,750,000 shares at TT$4.00 per ordinary share.

JUL 16, 2024 @ 8AM

Aug 9, 2024 @ 4PM

Investors can participate in the SOLIS IPO by submitting their applications electronically at www.goipo.jncb.com. GoIPO is a digital equities application platform powered by NCB Merchant Bank (Trinidad and Tobago) Limited.

Disclaimer: SOLIS has been approved as a reporting issuer and a receipt of Prospectus has been issued by the Trinidad and Tobago Securities and Exchange Commission (TTSEC). The TTSEC has not in any way evaluated the merits of the securities offered herein and any representations to the contrary is an offence. Investing involves risks. It is strongly recommended that prospective investors, prior to making any decisions regarding the SOLIS IPO, should thoroughly review the Prospectus and carefully consider their investment objectives and consult with professional advisors.

ADDRESS

Unit # 401 Fernandes Business Centre,

Eastern Main Road, Laventille, Trinidad, W.I

©2024 SOLIS - Eric Solis Marketing Ltd. | All rights reserved | Privacy Policy

Haydn Gittens

With over 30 years of experience in the financial sector, Mr. Hadyn Gittens has held senior roles across the Caribbean. He began his career at Republic Bank Limited, then spent 23 years with the RBC Royal Bank Group in Trinidad and Jamaica, culminating in the role of Group Head, Corporate Banking. In 2013, he became CEO of the Bank of Saint Lucia Limited for three years before serving as CEO of the Trinidad and Tobago Securities and Exchange Commission from 2017 to 2020. In January 2024, he was appointed Chairman of the Trinidad and Tobago Integrity Commission. Mr. Gittens is a highly qualified executive with expertise in Commercial and Corporate Banking, Credit Risk Management, Securities Regulation, and financial consultancy. He holds an MBA from the University of Manchester, UK, as well as an MSc in Accounting and a BSc (Hons) in Industrial Management from the University of the West Indies St. Augustine.